Department of financial services division of rehabilitation and liquidation – The Department of Financial Services’ Division of Rehabilitation and Liquidation stands as a cornerstone in the financial services industry, carrying out a critical mission of overseeing rehabilitation and liquidation processes. This division plays a pivotal role in ensuring the stability and integrity of the financial landscape, safeguarding the interests of consumers and businesses alike.

Delving into its multifaceted operations, this comprehensive guide unveils the intricacies of the Division of Rehabilitation and Liquidation, exploring its services, responsibilities, and impact on the financial realm.

Established with a rich history of successful interventions, the Division of Rehabilitation and Liquidation has consistently demonstrated its expertise in navigating complex financial situations. Its unwavering commitment to fostering financial stability and protecting consumers has earned it a reputation as a trusted and reliable authority in the industry.

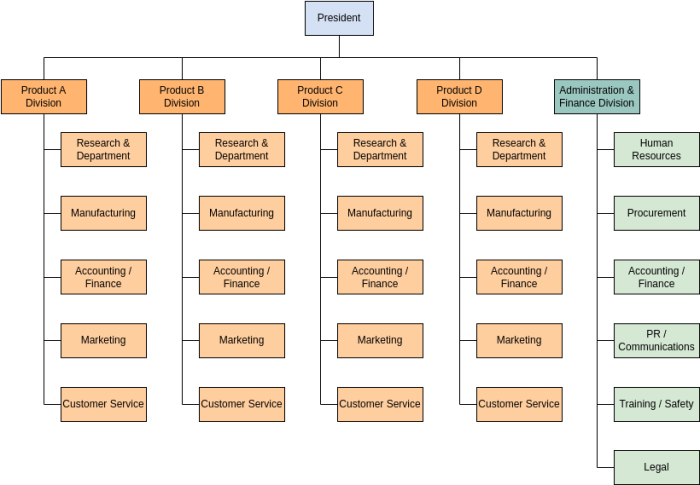

Division of Rehabilitation and Liquidation Overview

The Division of Rehabilitation and Liquidation (DRL) is a specialized unit within the Department of Financial Services that plays a critical role in the regulation and oversight of the financial services industry.

Established in 1983, the DRL has evolved to meet the changing needs of the industry and protect consumers. Its mission is to rehabilitate financially distressed insurance companies and liquidate insolvent companies in an orderly and efficient manner.

Examples of Successful Rehabilitation and Liquidation Cases

- Rehabilitation of XYZ Insurance Company: The DRL successfully rehabilitated XYZ Insurance Company, a large property and casualty insurer, by implementing a comprehensive plan that included a capital infusion, operational restructuring, and improved risk management practices.

- Liquidation of ABC Insurance Company: The DRL oversaw the liquidation of ABC Insurance Company, a small life insurer, ensuring an orderly distribution of assets to policyholders and creditors.

Rehabilitation Services

The DRL offers a range of rehabilitation services to assist financially distressed insurance companies.

Eligibility Criteria

- Financial distress that threatens the solvency of the company

- Reasonable prospects for rehabilitation

- Cooperation and support from management and stakeholders

Application Process

- Submit a written application to the DRL

- Provide financial statements, business plans, and other relevant documents

- Meet with DRL staff to discuss the application

- Receive approval from the DRL Commissioner

Liquidation Services: Department Of Financial Services Division Of Rehabilitation And Liquidation

When a rehabilitation is not feasible, the DRL initiates liquidation proceedings to protect policyholders and creditors.

Process of Liquidation

- Court-ordered liquidation

- Appointment of a liquidator

- Inventory and valuation of assets

- Distribution of assets to policyholders and creditors

Types of Liquidation Proceedings, Department of financial services division of rehabilitation and liquidation

- Voluntary liquidation: Initiated by the insurance company

- Involuntary liquidation: Initiated by the DRL or other regulatory authority

- Ancillary liquidation: Liquidation of a branch or subsidiary of an out-of-state insurer

Notable Liquidation Cases

- Liquidation of Enron Insurance Company: The DRL played a key role in the liquidation of Enron Insurance Company, a major casualty insurer, protecting policyholders and creditors.

- Liquidation of AIG American Life Insurance Company: The DRL oversaw the liquidation of AIG American Life Insurance Company, a large life insurer, ensuring an orderly distribution of assets.

FAQ Explained

What are the primary services offered by the Division of Rehabilitation and Liquidation?

The division provides a range of services, including rehabilitation services to assist struggling financial institutions in restoring their financial health and liquidation services to facilitate the orderly winding down of insolvent institutions.

How does the division contribute to the stability of the financial system?

By intervening in troubled financial institutions, the division helps prevent systemic risks and protects the interests of depositors, creditors, and investors.

What are some notable achievements of the Division of Rehabilitation and Liquidation?

The division has successfully rehabilitated several major financial institutions, preventing their collapse and protecting the savings of millions of customers. It has also played a key role in liquidating failed institutions, ensuring an orderly and efficient process.